Cash App

Images

Description

Cash App:

Managing money quickly and securely is a top priority. Cash App, developed by Square, Inc., has emerged as one of the most popular mobile payment platforms, making it easy to send, receive, and even invest money with just a few taps.

Whether you’re paying a friend for dinner, investing in stocks, or buying Bitcoin, Cash App provides a seamless and user-friendly experience. In this guide, we’ll explore how to get started with Cash App, its features, and how it can simplify your financial life.

What is Cash App?

Cash App is a mobile payment service that allows users to send and receive money, make purchases using a debit card, and even invest in stocks and Bitcoin.

Launched in 2013, Cash App has rapidly evolved beyond basic peer-to-peer payments, becoming a versatile tool for managing personal finances.

Originally designed as a simple way to transfer money, Cash App has expanded its offerings to include investing, getting direct deposits, and using a physical Cash Card for spending at stores or online.

How to Download Cash App

Getting started with Cash App is easy. It’s available for both iOS and Android devices, and the download process only takes a few moments.

Downloading for iOS

To download the Cash App on your iPhone or iPad:

- Go to the App Store.

- Search for “Cash App.”

- Tap “Get” to download and install the app.

Downloading for Android

For Android users, the process is similar:

- Visit the Google Play Store.

- Type “Cash App” into the search bar.

- Select the app and tap “Install.”

Installation and Setup Process

Once you’ve installed the Cash App, open the app and sign up using your email address or mobile number. Cash App will send you a verification code to confirm your details, and from there, you can set up your profile.

Signing Up for Cash App

Step-by-Step Guide to Creating an Account

- Open the Cash App and enter your email or phone number.

- Verify your information by entering the code sent to you.

- Choose a $Cashtag, which is your unique username that others can use to send money.

- Link your debit card or bank account to fund your transactions.

- Personalize your profile by adding your name and a profile picture.

Verifying Your Identity

You’ll need to verify your identity for larger transactions and access to more features like investing or direct deposit. This process involves entering your full name, date of birth, and the last four digits of your Social Security Number (SSN).

How Cash App Works

Cash App is incredibly straightforward, making it a popular choice for peer-to-peer payments. Here’s how it works:

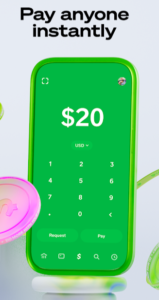

Sending and Receiving Money

- To send money: Enter the amount, tap “Pay,” and type in the recipient’s $Cashtag, email, or phone number.

- To receive money: Give the sender your $Cashtag or linked phone number/email. Once they send you the money, it will appear in your Cash App balance.

Adding and Linking Bank Accounts or Debit Cards

To fund your transactions, the Cash App allows you to link a debit card or bank account. Simply go to the settings menu and add your payment details. You can also link a credit card, though using it may incur additional transfer fees.

Cash App User Interface and Experience

One of Cash App’s standout features is its clean and user-friendly interface. Everything is organized into easy-to-navigate tabs, such as your balance, payments, and investments.

Navigating the App

At the bottom of the screen, you’ll find four main tabs:

- Home Tab: Shows your Cash App balance and recent activity.

- Cash Card Tab: Allows you to manage and customize your Cash Card.

- Investing Tab: Where you can buy and sell stocks or Bitcoin.

- Activity Tab: Tracks your transaction history.

Customization Options

You can personalize your profile with a unique $Cashtag and profile photo and customize your Cash Card with different designs and colors.

Using the Cash App for Payments

Cash App simplifies payments, whether you’re paying a friend or making a purchase.

How to Send Money to Friends or Family

- Tap the “Pay” button on the home screen.

- Enter the amount you want to send.

- Type the recipient’s $Cashtag, email, or phone number.

- Add a note if needed, and then tap “Pay.”

Requesting Money from Others

To request money:

- Tap the “Request” button.

- Enter the amount and the person’s $Cashtag or contact information.

- Send the request, and the other person will be notified.

Using Cash Apps in Stores and Online

You can also use Cash App to make online and in-store purchases. Simply enter your Cash Card details at checkout, or use the card in stores that accept Visa.

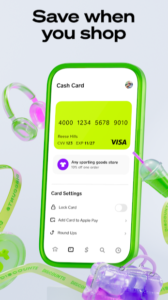

Cash App Card (Cash Card)

The Cash Card is a physical debit card linked to your Cash App balance. It allows you to spend your funds at any retailer that accepts Visa.

How to Order and Activate the Cash Card

To get a Cash Card:

- Tap the “Cash Card” tab.

- Select “Order Cash Card.”

- Choose your design, which can be personalized with your signature or emojis.

- After receiving your card in the mail, activate it by scanning the QR code included with the card.

Using the Cash Card for Purchases

Once activated, you can use the Cash Card like any other debit card, whether online or in stores. It draws from your Cash App balance; any transactions will appear in your activity feed.

Boosts: Cash Card Discounts and Perks

One unique feature of the Cash Card is Boosts, instant discounts you can apply at select retailers. These discounts change frequently and can save you money on everything from food to transportation.

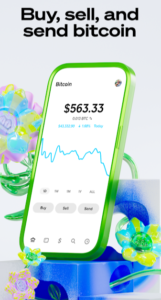

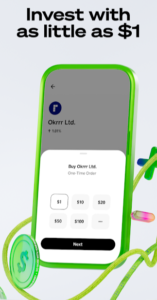

Cash App for Investing

Cash App also offers an easy way to invest in stocks and Bitcoin, making it accessible to beginners and casual investors.

Buying and Selling Stocks

To buy or sell stocks:

- Tap the Investing Tab.

- Choose a company or stock from the list or search for a specific one.

- Select the amount you wish to invest and confirm your purchase.

Investing in Bitcoin

Cash App allows you to buy, sell, and transfer Bitcoin if you’re interested in cryptocurrency. You can monitor its real-time value and trade directly through the app.

Cash App Taxes

Since Cash App allows for investing and receiving large payments, it’s important to stay aware of tax implications.

Understanding Cash App’s Tax Reporting

If you use Cash App for business transactions or exceed a certain earnings threshold, Cash App will issue a 1099 form for tax purposes. Using the app for professional services or side gigs, you must track your income and expenses.

Tracking Your Spending and Investments

Cash App provides an easy-to-read history of your transactions, which can be helpful for budgeting or preparing for tax season.

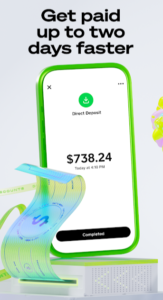

Cash App Direct Deposit

One of the most convenient features of Cash App is Direct Deposit, allowing you to receive your paycheck or tax refund directly into your Cash App account.

Setting Up Direct Deposit

To enable direct deposit:

- Go to the “Banking” tab.

- Find your Cash App routing and account numbers.

- Provide these to your employer or government agency to start receiving payments.

Benefits of Receiving Paychecks via Cash App

Direct deposits through Cash App are often available up to two days earlier than traditional banks, giving you quicker access to your money.

How to Add Money to Cash App

To add funds:

- Open the Cash App and tap “Add Cash.”

- Enter the amount you want to add.

- Select your linked bank account or debit card and confirm.

Withdrawing Money from Cash App

You can easily cash out your balance using a linked bank account.

Cash Out Options and Fees

Standard transfers to your bank account are free but may take 1-3 business days. For instant transfers, Cash App charges a small fee (typically 1.5% of the amount).

Security Features of Cash App

Cash App takes user security seriously, employing encryption and fraud detection to protect your data.

How Cash App Keeps Your Data Secure

All transactions are encrypted, and Cash App uses fraud detection technology to monitor for unusual activity. You can also enable two-factor authentication (2FA) for an extra layer of protection.

Enabling Additional Security Measures

In addition to 2FA, you can lock your Cash App with a PIN or Touch ID, adding another safeguard to your account.

Customer Support and Resources

Cash App provides multiple ways to get help if you ever run into issues.

How to Contact Cash App Support

You can contact support directly through the app by navigating the profile section and selecting “Support.” Cash App also has a dedicated help center on its website.

Troubleshooting Common Issues

Whether you’re dealing with a failed payment or need help with direct deposit, Cash App’s FAQ section is a great first resource for resolving issues quickly.

Pros and Cons of Using Cash App

Key Advantages of the App

- Free, fast, and easy to use for peer-to-peer payments.

- Investing in stocks and Bitcoin is accessible to beginners.

- Cash Card with Boosts offers instant savings.

- Convenient direct deposit feature for quick access to paychecks.

Potential Drawbacks

- Fees for instant transfers and credit card use.

- Limited availability for international users (U.S. and U.K. only).

- Lack of full-scale customer service (no phone support).

What's new

Various bug fixes and improvements.

Versions

| Version | Size | Requirements | Date |

|---|---|---|---|

| 4.65.0 | 25.48 MB | 7.0 | 13/09/2024 |

Related apps

Download links

How to install Cash App APK?

1. Tap the downloaded Cash App APK file.

2. Touch install.

3. Follow the steps on the screen.