Easypaisa – Payments Made Easy

Telenor Microfinance Bank Limited

May 20, 2016

Aug 21, 2024

84.75 MB

2.9.66

6.0

50,000,000+

Images

Description

Easypaisa: Transforming Digital Payments in Pakistan

Digital payment systems are revolutionizing how we handle money, and one of the frontrunners in this space in Pakistan is Easypaisa. With the advent of technology and increasing reliance on smartphones, digital wallets like Easypaisa are essential to our daily lives. But what exactly is Easypaisa, and how can it benefit you? Let’s dive in.

What is Easypaisa?

Easypaisa is Pakistan’s leading digital financial services platform. Launched in 2009, it was the country’s first mobile banking service, allowing users to send and receive money, pay bills, recharge mobile phones, and much more, all from the comfort of their homes. Developed by Telenor Pakistan, a prominent telecom company, Easypaisa has rapidly become a digital payment staple.

How Easypaisa Works

Easypaisa is a mobile wallet where users can deposit money, perform transactions, and pay for various services. It’s designed with a user-friendly interface that makes navigating the app straightforward, even for those who aren’t tech-savvy. To get started, users must download the Easypaisa app, available on Android and iOS platforms, and sign up using their mobile number.

Key Features of Easypaisa

Easypaisa isn’t just about sending money or paying bills. It offers a plethora of services that cater to both individual users and businesses. Here are some of the key features:

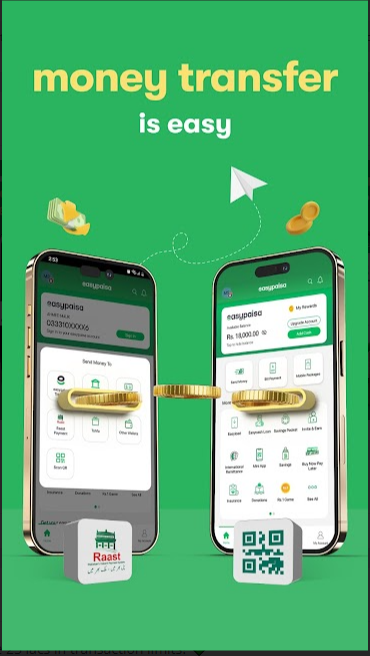

- Money Transfer and Payments: Easily send money to any Easypaisa wallet or bank account in Pakistan. Pay various vendors directly from the app.

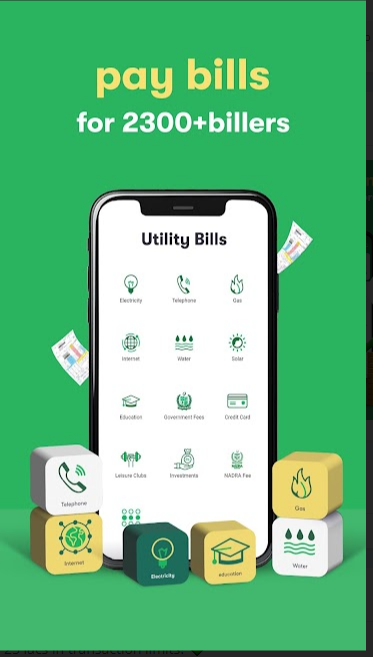

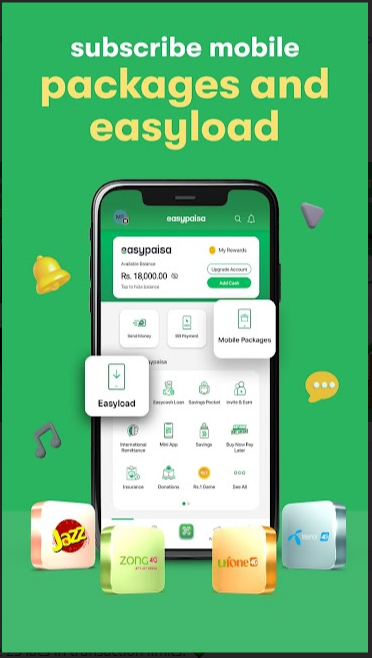

- Mobile Recharge and Bill Payments: With a few taps, you can recharge your mobile phone or pay utility bills. It supports all major telecom networks and utility services.

- Online Shopping and QR Payments: Shop online or pay in-store by scanning QR codes using the Easypaisa app, adding a layer of convenience to your shopping experience.

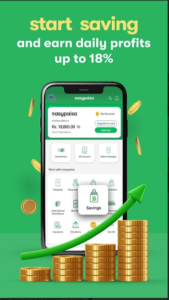

- Savings and Insurance Services: Easypaisa offers micro-savings accounts and insurance products, making financial management accessible to everyone.

- International Remittance: Users can receive money from abroad directly into their Easypaisa wallet, making it a valuable tool for families with overseas members.

Benefits of Using Easypaisa

Easypaisa brings numerous benefits to its users, making it a preferred choice for digital transactions:

- Convenience and Accessibility: The platform is available 24/7, allowing users to perform transactions anytime, anywhere, without the need to visit a bank.

- Security Measures in Place: Easypaisa employs robust security features, including biometric verification and encrypted transactions, ensuring your money is always safe.

- Cost-Effectiveness: With low transaction fees compared to traditional banking, Easypaisa offers a cost-effective alternative for managing finances.

Easypaisa vs. Traditional Banking

When comparing Easypaisa to traditional banking, there are distinct differences:

- Services Offered: While both provide essential financial services, Easypaisa’s digital platform offers more flexibility, allowing real-time transactions and payments.

- Pros and Cons: Easypaisa’s digital nature offers unparalleled convenience and lower costs. However, traditional banks may provide more comprehensive financial services like loans and credit cards.

Easypaisa for Businesses

Easypaisa isn’t just for individuals; it’s also a powerful business tool. It offers merchant services that enable businesses to accept digital payments from customers. This streamlines the payment process and expands the customer base by offering more payment options.

How to Use Easypaisa: A Step-by-Step Guide

Here’s a quick guide on how to start using Easypaisa:

- Creating an Account: Download the Easypaisa app, sign up using your mobile number, and follow the instructions to verify your identity.

- Adding Funds: Link your bank account or visit an Easypaisa retailer to deposit money into your wallet.

- Making Payments: Select the type of transaction—money transfer, bill payment, or mobile recharge—and follow the prompts to complete it.

Easypaisa App: Key Functionalities

The Easypaisa app is packed with features designed to enhance the user experience. You can manage your wallet, make payments, and even track your spending directly from the app’s dashboard. The intuitive design makes it easy for users to find and use the various functionalities.

Security Features of Easypaisa

Security is a top priority for Easypaisa. The app uses end-to-end encryption and secure socket layer (SSL) technology to protect users’ data. Additionally, biometric authentication and PIN codes add an extra layer of security, ensuring that only the account holder can access their wallet.

Customer Support and User Experience

Easypaisa prides itself on providing excellent customer service. Users can access support through multiple channels, including a 24/7 helpline, email, and in-app chat. This multi-tiered approach ensures that users can get help whenever they need it.

The Role of Easypaisa in Financial Inclusion

Easypaisa is playing a crucial role in promoting financial inclusion in Pakistan. Providing accessible financial services to unbanked and underbanked populations is helping to bridge the gap and bring more people into the formal economy. This has significant implications for the country’s overall economic development.

Easypaisa Promotions and Discounts

Easypaisa frequently offers promotions, such as cashback offers, discounts on bill payments, and exclusive deals with partner merchants. These promotions provide added value to users and encourage them to use the app more frequently.

Future of Easypaisa

The future looks bright for Easypaisa. With plans to expand its services and introduce new features, Easypaisa is set to become an even more integral part of Pakistan’s financial landscape. Potential developments could include further integration with international financial systems and enhanced business solutions.

What's new

• Upgrade to our digital account now and experience 25 lacs in transaction limits! 💚

• Bug fixes and other improvements.

Video

Related apps

Download links

How to install Easypaisa - Payments Made Easy APK?

1. Tap the downloaded Easypaisa - Payments Made Easy APK file.

2. Touch install.

3. Follow the steps on the screen.